Different types of layer 2s

2023 Oct 31

See all posts

Different types of layer 2s

Special thanks to Karl Floersch for feedback and review

The Ethereum layer 2 ecosystem has been expanding rapidly over the

last year. The EVM rollup ecosystem, traditionally featuring Arbitrum, Optimism and Scroll, and more recently Kakarot and Taiko, has been progressing quickly,

making great strides on improving their security; the L2beat page does a good

job of summarizing the state of each project. Additionally, we have seen

teams building sidechains also starting to build rollups (Polygon), layer 1 projects

seeking to move toward being validiums (Celo), and totally new efforts (Linea, Zeth...). Finally,

there is the not-just-EVM ecosystem: "almost-EVMs" like Zksync, extensions like Arbitrum

Stylus, and broader efforts like the Starknet ecosystem, Fuel and others.

One of the inevitable consequences of this is that we are seeing a

trend of layer 2 projects becoming more heterogeneous. I expect this

trend to continue, for a few key reasons:

- Some projects that are currently independent layer 1s are

seeking to come closer to the Ethereum ecosystem, and possibly

become layer 2s. These projects will likely want a step-by-step

transition. Transitioning all at once now would cause a decrease in

usability, as the technology is not yet ready to put everything on a

rollup. Transitioning all at once later risks sacrificing momentum and

being too late to be meaningful.

- Some centralized projects want to give their users more

security assurances, and are exploring blockchain-based routes for doing

so. In many cases, these are the projects that would have

explored "permissioned consortium chains" in a previous era.

Realistically, they probably only need a "halfway-house" level of

decentralization. Additionally, their often very high level of

throughput makes them unsuitable even for rollups, at least in the short

term.

- Non-financial applications, like games or social media, want

to be decentralized but need only a halfway-house level of

security. In the social media case, this realistically

involves treating different parts of the app differently: rare and

high-value activity like username registration and account recovery

should be done on a rollup, but frequent and low-value activity like

posts and votes need less security. If a chain failure causes your post

to disappear, that's an acceptable cost. If a chain failure causes you

to lose your account, that is a much bigger problem.

A big theme is that while applications and users that are on

the Ethereum layer 1 today will be fine paying smaller but

still visible rollup fees in the short term, users from the

non-blockchain world will not: it's easier to justify paying

$0.10 if you were paying $1 before than if you were paying $0 before.

This applies both to applications that are centralized today, and to

smaller layer 1s, which do typically have very low fees while their

userbase remains small.

A natural question that emerges is: which of these complicated

tradeoffs between rollups, validiums and other systems makes sense for a

given application?

Rollups vs

validiums vs disconnected systems

The first dimension of security vs scale that we will explore can be

described as follows: if you have an asset that is issued on L1,

then deposited into the L2, then transferred to you, what level of

guarantee do you have that you will be able to take the asset back to

the L1?

There is also a parallel question: what is the technology choice that

is resulting in that level of guarantee, and what are the tradeoffs of

that technology choice?

We can describe this simply using a chart:

| Rollup |

Computation proven via fraud proofs or ZK-SNARKs, data stored on

L1 |

You can always bring the asset back to L1 |

L1 data availability + SNARK-proving or redundant execution to catch

errors |

| Validium |

Computation proven via ZK-SNARKs (can't use fraud proofs), data

stored on a server or other separate system |

Data availability failure can cause assets to be lost, but

not stolen |

SNARK-proving |

| Disconnected |

A separate chain (or server) |

Trust one or a small group of people not to steal your funds or lose

the keys |

Very cheap |

It's worth mentioning that this is a simplified schema, and

there are lots of intermediate options. For example:

- Between rollup and validium: a validium where

anyone could make an on-chain payment to cover the cost of transaction

fees, at which point the operator would be forced to provide some data

onto the chain or else lose a deposit.

- Between plasma and validium: a Plasma system offers

rollup-like security guarantees with off-chain data availability, but it

supports only a limited number of applications. A system could

offer a full EVM, and offer Plasma-level guarantees to users that do not

use those more complicated applications, and validium-level guarantees

to users that do.

These intermediate options can be viewed as being on a spectrum

between a rollup and a validium. But what motivates applications to

choose a particular point on that spectrum, and not some point further

left or further right? Here, there are two major factors:

- The cost of Ethereum's native data availability, which will

decrease over time as technology improves. Ethereum's next hard

fork, Dencun,

introduces EIP-4844 (aka

"proto-danksharding"), which provides ~32 kB/sec of onchain data

availability. Over the next few years, this is expected to increase in

stages as full

danksharding is rolled out, eventually targeting around ~1.3 MB/sec

of data availability. At the same time, improvements

in data compression will let us do more with the same amount of

data.

- The application's own needs: how much would users suffer

from high fees, versus from something in the application going

wrong? Financial applications would lose more from application

failures; games and social media involve lots of activity per user, and

relatively low-value activity, so a different security tradeoff makes

sense for them.

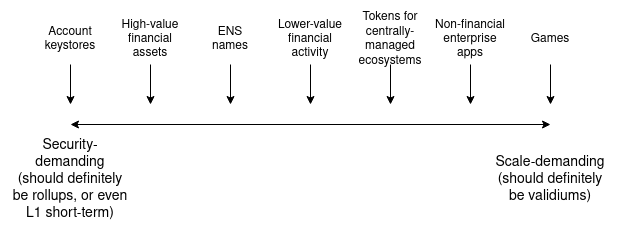

Approximately, this tradeoff looks something like this:

Another type of partial guarantee worth mentioning is

pre-confirmations. Pre-confirmations are messages

signed by some set of participants in a rollup or validium that say "we

attest that these transactions are included in this order, and the

post-state root is this". These participants may well sign a

pre-confirmation that does not match some later reality, but if they do,

a deposit gets burned. This is useful for low-value applications like

consumer payments, while higher-value applications like

multimillion-dollar financial transfers will likely wait for a "regular"

confirmation backed by the system's full security.

Pre-confirmations can be viewed as another example of a

hybrid system, similar to the "plasma / validium hybrid"

mentioned above, but this time hybridizing between a rollup (or

validium) that has full security but high latency, and a system with a

much lower security level that has low latency. Applications that need

lower latency get lower security, but can live in the same ecosystem as

applications that are okay with higher latency in exchange for maximum

security.

Trustlessly reading

Ethereum

Another less-thought-about, but still highly important, form of

connection has to do with a system's ability to read

the Ethereum blockchain. Particularly, this includes

being able to revert if Ethereum reverts. To see why

this is valuable, consider the following situation:

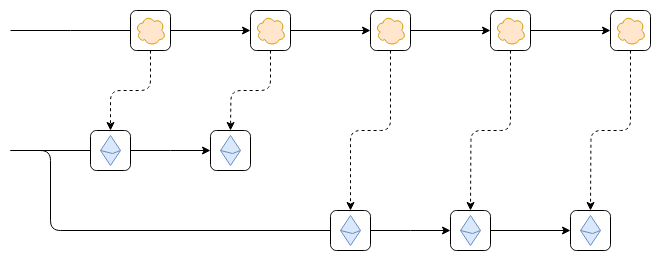

Suppose that, as shown in the diagram, the Ethereum chain reverts.

This could be a temporary hiccup within an epoch, while the chain has

not finalized, or it could be an inactivity

leak period where the chain is not finalizing for an extended

duration because too many validators are offline.

The worst-case scenario that can arise from this is as follows.

Suppose that the first block from the top chain reads some data from the

leftmost block on the Ethereum chain. For example, someone on Ethereum

deposits 100 ETH into the top chain. Then, Ethereum reverts. However,

the top chain does not revert. As a result, future blocks of the top

chain correctly follow new blocks from the newly correct Ethereum chain,

but the consequences of the now-erroneous older link (namely,

the 100 ETH deposit) are still part of the top chain. This exploit could

allow printing money, turning the bridged ETH on the top chain into a

fractional reserve.

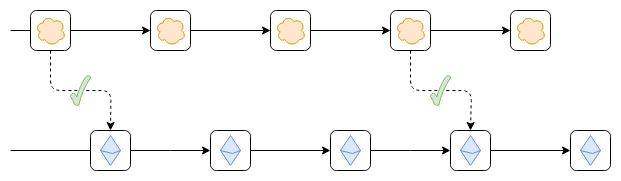

There are two ways to solve this problem:

- The top chain could only read finalized blocks of

Ethereum, so it would never need to revert.

- The top chain could revert if Ethereum reverts.

Both prevent this issue. The former is easier to implement, but may

cause a loss of functionality for an extended duration if Ethereum

enters an inactivity leak period. The latter is harder to implement, but

ensures the best possible functionality at all times.

Note that (1) does have one edge case. If a 51% attack on Ethereum

creates two new incompatible blocks that both appear finalized at the

same time, then the top chain may well lock on to the wrong one (ie. the

one that Ethereum social consensus does not eventually favor), and would

have to revert to switch to the right one. Arguably, there is no need to

write code to handle this case ahead of time; it could simply be handled

by hard-forking the top chain.

The ability of a chain to trustlessly read Ethereum is valuable for

two reasons:

- It reduces security issues involved in bridging tokens issued on

Ethereum (or other L2s) to that chain

- It allows account abstraction wallets that use the shared keystore

architecture to hold assets on that chain securely.

- is important, though arguably this need is already widely

recognized. (2) is important too, because it means that you can have a

wallet that allows easy key changes and that holds assets across a large

number of different chains.

Does having a bridge

make you a validium?

Suppose that the top chain starts out as a separate chain, and then

someone puts onto Ethereum a bridge contract. A bridge contract is

simply a contract that accepts block headers of the top chain, verifies

that any header submitted to it comes with a valid certificate showing

that it was accepted by the top chain's consensus, and adds that header

to a list. Applications can build on top of this to implement

functionality such as depositing and withdrawing tokens. Once such a

bridge is in place, does that provide any of the asset security

guarantees we mentioned earlier?

So far, not yet! For two reasons:

- We're validating that the blocks were signed, but not that

the state transitions are correct. Hence, if you have an asset issued on

Ethereum deposited to the top chain, and the top chain's validators go

rogue, they can sign an invalid state transition that steals those

assets.

- The top chain still has no way to read Ethereum. Hence, you

can't even deposit Ethereum-native assets onto the top chain without

relying on some other (possibly insecure) third-party bridge.

Now, let's make the bridge a validating bridge: it

checks not just consensus, but also a ZK-SNARK proving that the state of

any new block was computed correctly.

Once this is done, the top chain's validators can no longer steal

your funds. They can publish a block with unavailable data,

preventing everyone from withdrawing, but they cannot steal (except by

trying to extract a ransom for users in exchange for revealing the data

that allows them to withdraw). This is the same security model as a

validium.

However, we still have not solved the second problem: the top chain

cannot read Ethereum.

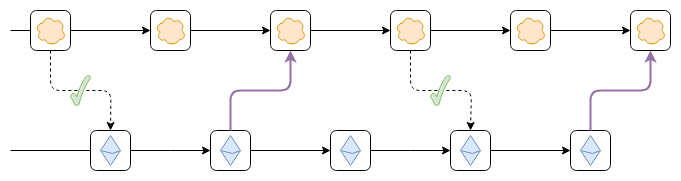

To do that, we need to do one of two things:

- Put a bridge contract validating finalized Ethereum blocks inside

the top chain.

- Have each block in the top chain contain a hash of a recent Ethereum

block, and have a fork choice rule that enforces the hash linkings. That

is, a top chain block that links to an Ethereum block that is not in the

canonical chain is itself non-canonical, and if a top chain block links

to an Ethereum block that was at first canonical, but then becomes

non-canonical, the top chain block must also become non-canonical.

The purple links can be either hash links or a bridge contract

that verifies Ethereum's consensus.

Is this enough? As it turns out, still no, because of a few small

edge cases:

- What happens if Ethereum gets 51% attacked?

- How do you handle Ethereum hard fork upgrades?

- How do you handle hard fork upgrades of your chain?

A 51% attack on Ethereum would have similar consequences to a 51%

attack on the top chain, but in reverse. A hard fork of Ethereum risks

making the bridge of Ethereum inside the top chain no longer valid.

A social commitment to revert if Ethereum reverts a finalized

block, and to hard-fork if Ethereum hard-forks, is the cleanest way to

resolve this. Such a commitment may well never need to be

actually executed on: you could have a governance gadget on the top

chain activate if it sees proof of a possible attack or hard fork, and

only hard-fork the top chain if the governance gadget fails.

The only viable answer to (3) is, unfortunately, to have some form of

governance gadget on Ethereum that can make the bridge contract on

Ethereum aware of hard-fork upgrades of the top chain.

Summary: two-way validating bridges are

almost enough to make a chain a validium. The main remaining

ingredient is a social commitment that if something exceptional happens

in Ethereum that makes the bridge no longer work, the other chain will

hard-fork in response.

Conclusions

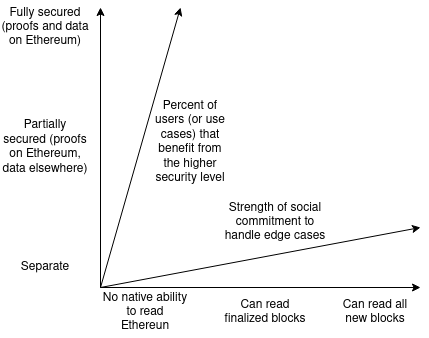

There are two key dimensions to "connectedness to Ethereum":

- Security of withdrawing to Ethereum

- Security of reading Ethereum

These are both important, and have different considerations. There is

a spectrum in both cases:

Notice that both dimensions each have two distinct ways of measuring

them (so really there's four dimensions?): security of

withdrawing can be measured by (i) security level, and (ii)

what percent of users or use cases benefit from the highest security

level, and security of reading can be measured by (i)

how quickly the chain can read Ethereum's blocks, particularly finalized

blocks vs any blocks, and (ii) the strength of the chain's social

commitment to handle edge cases such as 51% attacks and hard forks.

There is value in projects in many regions of this design space. For

some applications, high security and tight connectedness are important.

For others, something looser is acceptable in exhcnage for greater

scalability. In many cases, starting with something looser today, and

moving to a tighter coupling over the next decade as technology

improves, may well be optimal.

Different types of layer 2s

2023 Oct 31 See all postsSpecial thanks to Karl Floersch for feedback and review

The Ethereum layer 2 ecosystem has been expanding rapidly over the last year. The EVM rollup ecosystem, traditionally featuring Arbitrum, Optimism and Scroll, and more recently Kakarot and Taiko, has been progressing quickly, making great strides on improving their security; the L2beat page does a good job of summarizing the state of each project. Additionally, we have seen teams building sidechains also starting to build rollups (Polygon), layer 1 projects seeking to move toward being validiums (Celo), and totally new efforts (Linea, Zeth...). Finally, there is the not-just-EVM ecosystem: "almost-EVMs" like Zksync, extensions like Arbitrum Stylus, and broader efforts like the Starknet ecosystem, Fuel and others.

One of the inevitable consequences of this is that we are seeing a trend of layer 2 projects becoming more heterogeneous. I expect this trend to continue, for a few key reasons:

A big theme is that while applications and users that are on the Ethereum layer 1 today will be fine paying smaller but still visible rollup fees in the short term, users from the non-blockchain world will not: it's easier to justify paying $0.10 if you were paying $1 before than if you were paying $0 before. This applies both to applications that are centralized today, and to smaller layer 1s, which do typically have very low fees while their userbase remains small.

A natural question that emerges is: which of these complicated tradeoffs between rollups, validiums and other systems makes sense for a given application?

Rollups vs validiums vs disconnected systems

The first dimension of security vs scale that we will explore can be described as follows: if you have an asset that is issued on L1, then deposited into the L2, then transferred to you, what level of guarantee do you have that you will be able to take the asset back to the L1?

There is also a parallel question: what is the technology choice that is resulting in that level of guarantee, and what are the tradeoffs of that technology choice?

We can describe this simply using a chart:

It's worth mentioning that this is a simplified schema, and there are lots of intermediate options. For example:

These intermediate options can be viewed as being on a spectrum between a rollup and a validium. But what motivates applications to choose a particular point on that spectrum, and not some point further left or further right? Here, there are two major factors:

Approximately, this tradeoff looks something like this:

Another type of partial guarantee worth mentioning is pre-confirmations. Pre-confirmations are messages signed by some set of participants in a rollup or validium that say "we attest that these transactions are included in this order, and the post-state root is this". These participants may well sign a pre-confirmation that does not match some later reality, but if they do, a deposit gets burned. This is useful for low-value applications like consumer payments, while higher-value applications like multimillion-dollar financial transfers will likely wait for a "regular" confirmation backed by the system's full security.

Pre-confirmations can be viewed as another example of a hybrid system, similar to the "plasma / validium hybrid" mentioned above, but this time hybridizing between a rollup (or validium) that has full security but high latency, and a system with a much lower security level that has low latency. Applications that need lower latency get lower security, but can live in the same ecosystem as applications that are okay with higher latency in exchange for maximum security.

Trustlessly reading Ethereum

Another less-thought-about, but still highly important, form of connection has to do with a system's ability to read the Ethereum blockchain. Particularly, this includes being able to revert if Ethereum reverts. To see why this is valuable, consider the following situation:

Suppose that, as shown in the diagram, the Ethereum chain reverts. This could be a temporary hiccup within an epoch, while the chain has not finalized, or it could be an inactivity leak period where the chain is not finalizing for an extended duration because too many validators are offline.

The worst-case scenario that can arise from this is as follows. Suppose that the first block from the top chain reads some data from the leftmost block on the Ethereum chain. For example, someone on Ethereum deposits 100 ETH into the top chain. Then, Ethereum reverts. However, the top chain does not revert. As a result, future blocks of the top chain correctly follow new blocks from the newly correct Ethereum chain, but the consequences of the now-erroneous older link (namely, the 100 ETH deposit) are still part of the top chain. This exploit could allow printing money, turning the bridged ETH on the top chain into a fractional reserve.

There are two ways to solve this problem:

Note that (1) does have one edge case. If a 51% attack on Ethereum creates two new incompatible blocks that both appear finalized at the same time, then the top chain may well lock on to the wrong one (ie. the one that Ethereum social consensus does not eventually favor), and would have to revert to switch to the right one. Arguably, there is no need to write code to handle this case ahead of time; it could simply be handled by hard-forking the top chain.

The ability of a chain to trustlessly read Ethereum is valuable for two reasons:

Does having a bridge make you a validium?

Suppose that the top chain starts out as a separate chain, and then someone puts onto Ethereum a bridge contract. A bridge contract is simply a contract that accepts block headers of the top chain, verifies that any header submitted to it comes with a valid certificate showing that it was accepted by the top chain's consensus, and adds that header to a list. Applications can build on top of this to implement functionality such as depositing and withdrawing tokens. Once such a bridge is in place, does that provide any of the asset security guarantees we mentioned earlier?

So far, not yet! For two reasons:

Now, let's make the bridge a validating bridge: it checks not just consensus, but also a ZK-SNARK proving that the state of any new block was computed correctly.

Once this is done, the top chain's validators can no longer steal your funds. They can publish a block with unavailable data, preventing everyone from withdrawing, but they cannot steal (except by trying to extract a ransom for users in exchange for revealing the data that allows them to withdraw). This is the same security model as a validium.

However, we still have not solved the second problem: the top chain cannot read Ethereum.

To do that, we need to do one of two things:

The purple links can be either hash links or a bridge contract that verifies Ethereum's consensus.

Is this enough? As it turns out, still no, because of a few small edge cases:

A 51% attack on Ethereum would have similar consequences to a 51% attack on the top chain, but in reverse. A hard fork of Ethereum risks making the bridge of Ethereum inside the top chain no longer valid. A social commitment to revert if Ethereum reverts a finalized block, and to hard-fork if Ethereum hard-forks, is the cleanest way to resolve this. Such a commitment may well never need to be actually executed on: you could have a governance gadget on the top chain activate if it sees proof of a possible attack or hard fork, and only hard-fork the top chain if the governance gadget fails.

The only viable answer to (3) is, unfortunately, to have some form of governance gadget on Ethereum that can make the bridge contract on Ethereum aware of hard-fork upgrades of the top chain.

Summary: two-way validating bridges are almost enough to make a chain a validium. The main remaining ingredient is a social commitment that if something exceptional happens in Ethereum that makes the bridge no longer work, the other chain will hard-fork in response.

Conclusions

There are two key dimensions to "connectedness to Ethereum":

These are both important, and have different considerations. There is a spectrum in both cases:

Notice that both dimensions each have two distinct ways of measuring them (so really there's four dimensions?): security of withdrawing can be measured by (i) security level, and (ii) what percent of users or use cases benefit from the highest security level, and security of reading can be measured by (i) how quickly the chain can read Ethereum's blocks, particularly finalized blocks vs any blocks, and (ii) the strength of the chain's social commitment to handle edge cases such as 51% attacks and hard forks.

There is value in projects in many regions of this design space. For some applications, high security and tight connectedness are important. For others, something looser is acceptable in exhcnage for greater scalability. In many cases, starting with something looser today, and moving to a tighter coupling over the next decade as technology improves, may well be optimal.