A Note On Charity Through Marginal Price Discrimination

2017 Mar 11

See all posts

A Note On Charity Through Marginal Price Discrimination

Updated 2018-07-28. See end note.

The following is an interesting idea that I had two years ago that I

personally believe has promise and could be easily implemented in the

context of a blockchain ecosystem, though if desired it could certainly

also be implemented with more traditional technologies (blockchains

would help get the scheme network effects by putting the core logic on a

more neutral platform).

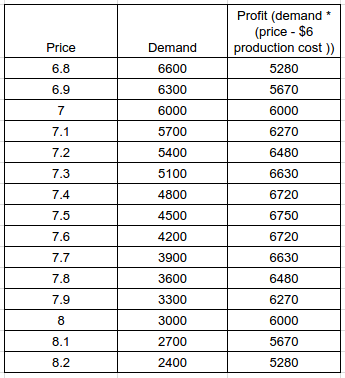

Suppose that you are a restaurant selling sandwiches, and you

ordinarily sell sandwiches for $7.50. Why did you choose to sell them

for $7.50, and not $7.75 or $7.25? It clearly can't be the case that the

cost of production is exactly $7.49999, as in that case you would be

making no profit, and would not be able to cover fixed costs; hence, in

most normal situations you would still be able to make some

profit if you sold at $7.25 or $7.75, though less. Why less at $7.25?

Because the price is lower. Why less at $7.75? Because you get fewer

customers. It just so happens that $7.50 is the point at which the

balance between those two factors is optimal for you.

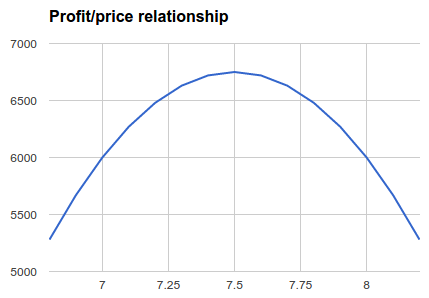

Notice one consequence of this: if you make a slight

distortion to the optimal price, then even compared to the magnitude of

the distortion the losses that you face are minimal. If you raise prices

by 1%, from $7.50 to $7.575, then your profit declines from $6750 to

$6733.12 - a tiny 0.25% reduction. And that's profit - if you

had instead donated 1% of the price of each sandwich, it would have

reduced your profit by 5%. The smaller the distortion the more favorable

the ratio: raising prices by 0.2% only cuts your profits down by

0.01%.

Now, you could argue that stores are not perfectly rational, and not

perfectly informed, and so they may not actually be charging at

optimal prices, all factors considered. However, if you don't know what

direction the deviation is in for any given store, then even still,

in expectation, the scheme works the same way - except instead

of losing $17 it's more like flipping a coin where half the time you

gain $50 and half the time you lose $84. Furthermore, in the more

complex scheme that we will describe later, we'll be adjusting prices in

both directions simultaneously, and so there will not even be any extra

risk - no matter how correct or incorrect the original price was, the

scheme will give you a predictable small net loss.

Also, the above example was one where marginal costs are high, and

customers are picky about prices - in the above model, charging $9 would

have netted you no customers at all. In a situation where marginal costs are

much lower, and customers are less price-sensitive, the losses from

raising or lowering prices would be even lower.

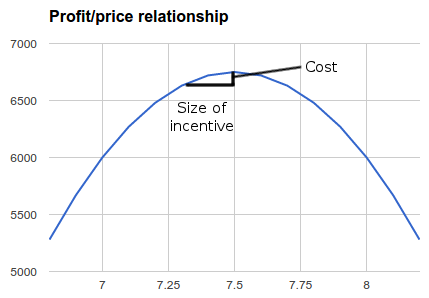

So what is the point of all this? Well, suppose that our sandwich

shop changes its policy: it sells sandwiches for $7.55 to the general

public, but lowers the prices to $7.35 for people who volunteered in

some charity that maintains some local park (say, this is 25% of the

population). The store's new profit is \(\$6682.5 \cdot 0.25+\$6742.5 \cdot

0.75=\$6727.5\) (that's a $22.5 loss), but the result is that you

are now paying all 4500 of your customers 20 cents each to volunteer at

that charity - an incentive size of $900 (if you just count the

customers who actually do volunteer, $225). So the store loses a bit,

but gets a huge amount of leverage, de-facto contributing at least $225

depending on how you measure it for a cost of only $22.5.

Now, what we can start to do is build up an ecosystem of "stickers",

which are non-transferable digital "tokens" that organizations hand out

to people who they think are contributing to worthy causes. Tokens could

be organized by category (eg. poverty relief, science research,

environmental, local community projects, open source software

development, writing good blogs), and merchants would be free to charge

marginally lower prices to holders of the tokens that represent whatever

causes they personally approve of.

The next stage is to make the scheme recursive - being or working for

a merchant that offers lower prices to holders of green stickers is

itself enough to merit you a green sticker, albeit one that is of lower

potency and gives you a lower discount. This way, if an entire community

approves of a particular cause, it may actually be profit-maximizing to

start offering discounts for the associated sticker, and so economic and

social pressure will maintain a certain level of spending and

participation toward the cause in a stable equilibrium.

As far as implementation goes, this requires:

- A standard for stickers, including wallets where people can hold

stickers

- Payment systems that have support for charging lower prices to

sticker holders included

- At least a few sticker-issuing organizations (the lowest overhead is

likely to be issuing stickers for charity donations, and for easily

verifiable online content, eg. open source software and blogs)

So this is something that can certainly be bootstrapped within a

small community and user base and then let to grow over time.

Update 2017.03.14: here

is an economic model/simulation showing the above implemented as a

Python script.

Update 2018.07.28: after discussions with others (Glen Weyl and

several Reddit commenters), I realized a few extra things about this

mechanism, some encouraging and some worrying:

- The above mechanism could be used not just by charities, but also by

centralized corporate actors. For example, a large corporation could

offer a bribe of $40 to any store that offers the 20-cent discount to

customers of its products, gaining additional revenue much higher than

$40. So it's empowering but potentially dangerous in the wrong hands... (I

have not researched it but I'm sure this kind of technique is used in

various kinds of loyalty programs already)

- The above mechanism has the property that a merchant can "donate"

\(\$x\) to charity at a cost of \(\$x^{2}\) (note: \(x^{2}<x\) at the scales we're talking

about here). This gives it a structure that's economically optimal in

certain ways (see quadratic

voting), as a merchant that feels twice as strongly about some

public good will be inclined to offer twice as large a subsidy, whereas

most other social choice mechanisms tend to either undervalue (as in

traditional voting) or overvalue (as in buying policies via lobbying)

stronger vs weaker preferences.

A Note On Charity Through Marginal Price Discrimination

2017 Mar 11 See all postsUpdated 2018-07-28. See end note.

The following is an interesting idea that I had two years ago that I personally believe has promise and could be easily implemented in the context of a blockchain ecosystem, though if desired it could certainly also be implemented with more traditional technologies (blockchains would help get the scheme network effects by putting the core logic on a more neutral platform).

Suppose that you are a restaurant selling sandwiches, and you ordinarily sell sandwiches for $7.50. Why did you choose to sell them for $7.50, and not $7.75 or $7.25? It clearly can't be the case that the cost of production is exactly $7.49999, as in that case you would be making no profit, and would not be able to cover fixed costs; hence, in most normal situations you would still be able to make some profit if you sold at $7.25 or $7.75, though less. Why less at $7.25? Because the price is lower. Why less at $7.75? Because you get fewer customers. It just so happens that $7.50 is the point at which the balance between those two factors is optimal for you.

Notice one consequence of this: if you make a slight distortion to the optimal price, then even compared to the magnitude of the distortion the losses that you face are minimal. If you raise prices by 1%, from $7.50 to $7.575, then your profit declines from $6750 to $6733.12 - a tiny 0.25% reduction. And that's profit - if you had instead donated 1% of the price of each sandwich, it would have reduced your profit by 5%. The smaller the distortion the more favorable the ratio: raising prices by 0.2% only cuts your profits down by 0.01%.

Now, you could argue that stores are not perfectly rational, and not perfectly informed, and so they may not actually be charging at optimal prices, all factors considered. However, if you don't know what direction the deviation is in for any given store, then even still, in expectation, the scheme works the same way - except instead of losing $17 it's more like flipping a coin where half the time you gain $50 and half the time you lose $84. Furthermore, in the more complex scheme that we will describe later, we'll be adjusting prices in both directions simultaneously, and so there will not even be any extra risk - no matter how correct or incorrect the original price was, the scheme will give you a predictable small net loss.

Also, the above example was one where marginal costs are high, and customers are picky about prices - in the above model, charging $9 would have netted you no customers at all. In a situation where marginal costs are much lower, and customers are less price-sensitive, the losses from raising or lowering prices would be even lower.

So what is the point of all this? Well, suppose that our sandwich shop changes its policy: it sells sandwiches for $7.55 to the general public, but lowers the prices to $7.35 for people who volunteered in some charity that maintains some local park (say, this is 25% of the population). The store's new profit is \(\$6682.5 \cdot 0.25+\$6742.5 \cdot 0.75=\$6727.5\) (that's a $22.5 loss), but the result is that you are now paying all 4500 of your customers 20 cents each to volunteer at that charity - an incentive size of $900 (if you just count the customers who actually do volunteer, $225). So the store loses a bit, but gets a huge amount of leverage, de-facto contributing at least $225 depending on how you measure it for a cost of only $22.5.

Now, what we can start to do is build up an ecosystem of "stickers", which are non-transferable digital "tokens" that organizations hand out to people who they think are contributing to worthy causes. Tokens could be organized by category (eg. poverty relief, science research, environmental, local community projects, open source software development, writing good blogs), and merchants would be free to charge marginally lower prices to holders of the tokens that represent whatever causes they personally approve of.

The next stage is to make the scheme recursive - being or working for a merchant that offers lower prices to holders of green stickers is itself enough to merit you a green sticker, albeit one that is of lower potency and gives you a lower discount. This way, if an entire community approves of a particular cause, it may actually be profit-maximizing to start offering discounts for the associated sticker, and so economic and social pressure will maintain a certain level of spending and participation toward the cause in a stable equilibrium.

As far as implementation goes, this requires:

So this is something that can certainly be bootstrapped within a small community and user base and then let to grow over time.

Update 2017.03.14: here is an economic model/simulation showing the above implemented as a Python script.

Update 2018.07.28: after discussions with others (Glen Weyl and several Reddit commenters), I realized a few extra things about this mechanism, some encouraging and some worrying: